Investing during bull run periods takes some strategy

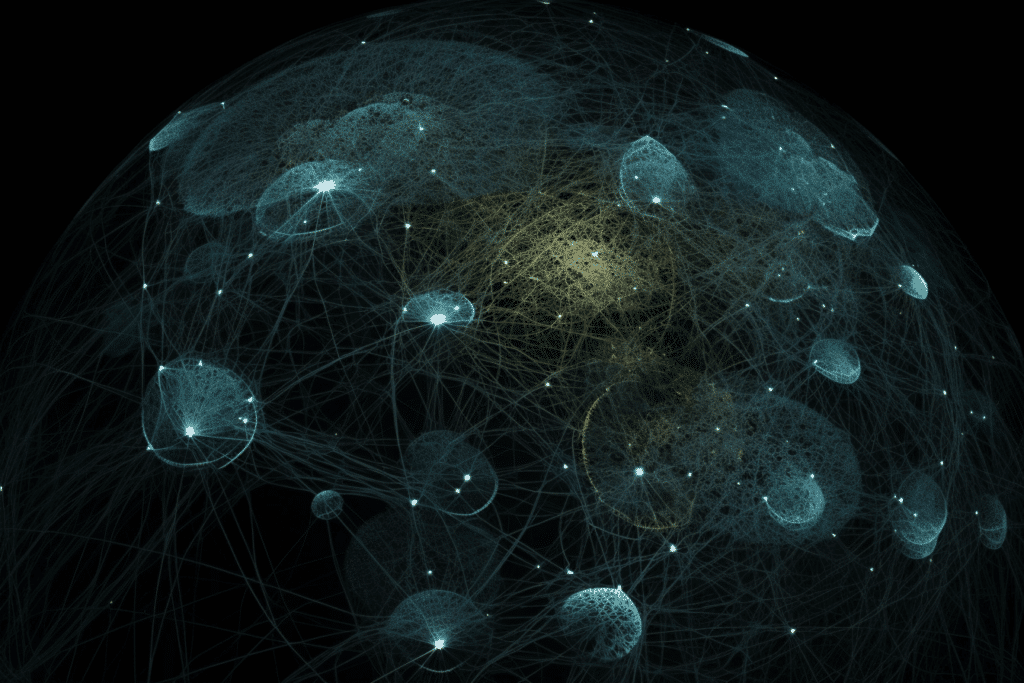

First of all, a quick reminder of what a bull run is: a period where prices are rising within the crypto market. It is also characterized by great upward trends, with the pressure of digital assets sales going down and trading volume going up.

Bull markets usually last from months, even years. Just like bear markets, even if there are many differences between the two.

Let’s keep in mind that if the bull run shows a good dynamic and opportunities for investors to profit from interesting returns, following the trends really closely is mandatory to spot a shift in the tendencies and act in consequences.

And while there are many types of crypto investors, there are also some common crypto investment techniques, met during a bull run market. Stay with me, I’m going to run you through the 7 common methods investors use to invest and do profit.

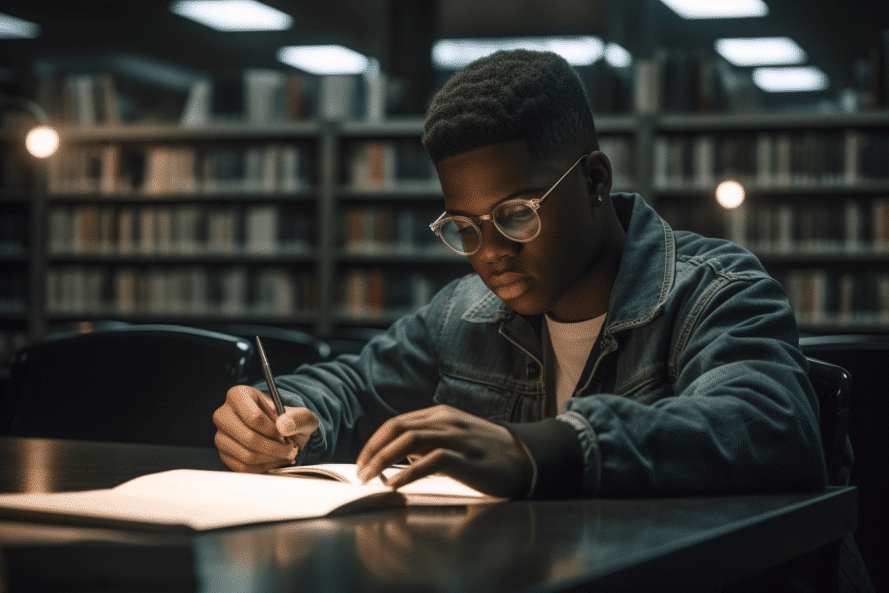

Get ready to invest during the bull run

If we are not sure we are entering a bull market period yet, there are some things to know like the useful techniques to start investing in crypto. Ready to dive in?

- ‘The Buy and Hold’ (HODL) technique:

Typical behaviour? Investors buy digital assets and choose to hold it for an extended period of time to sell it later on, regardless of short-term price fluctuations.

This is what most of $GALEON holders are doing when purchasing their tokens and staking them.

Basically, Buy and Hold technique can be paralleled with when your great-great-grandparents bought gold and stack it within their mattress. - The ‘Dollar-Cost Averaging’ (DCA):

DCA involves investing a fixed amount of money (weekly or monthly) at regular intervals regardless of the current price of the cryptocurrency. This strategy helps smoothing out the impact of market volatility and can be effective during bull markets to gradually accumulate assets over time.

It is also a non-stressful technique, it does not require staying up-to-date everyday, and that implies a long-term vision: one has to be convinced the asset will perform in the long run.

The best way to operate? Defining the total amount you want to allocate to a specific asset during the next 12 months and the frequency of the entries (it could be weekly or monthly entries). Then, you just have to divide this total amount to the number of entries that will be made in the 12 upcoming months.

Another parallel here would be when you pay for your mortgage: your DCA is organized by your bank for you to invest in real estate. - The trading method:

Trading actively involves to buy and sell cryptocurrencies frequently to take advantage of short-term price movements. Investors may use technical analysis, chart patterns, or key indicators to identify entry and exit points for trades. They follow the trends, breakout & momentum trading.

Compared to the technique above, it is more stressful and requires time to check those indicators and stay on page. You need to choose to build a trading plan in advance, then pick up your best crypto trading platform, and closely monitor your investments.

For example, an investor could do a prediction on the fall in value of the USD token. Then, he would decide to sell it against Bitcoin tokens. If his prediction was right, he would benefit from this trade. If not because USD would rise against Bitcoin, he would lose from this transaction.

It’s like putting your shoes in Dicaprio’s in the Wolf of Wall Street: buy stocks when they are low and sell them high on a daily basis. But careful here: daily trading is a real know-how! There are no traders that succeed without putting any limits to prevent from unconsidered risks. Every trader knows it. Jerome Kerviel learned it the hard way. - The leveraged trading:

Some investors may use leverage to amplify their trading positions during bull market and gain potential return increasing their profits.

Traders would borrow funds to multiply the potential returns on their investments. In doing so, they can better control a larger position with a smaller amount of cap. But this technique also comes with higher risks, as losses can exceed the initial investments. It is basically trading with others’ money.

For instance, if he uses a crypto leverage of 5x, it would allow him to control a position 5 times larger than what he invested initially. Let’s say he had $100, he could then open a position of $500 using this leverage. - The ‘swing-trading’ technique:

Investors would buy and sell with big parts of their portfolio of digital assets to maximize profits. This technique implies significant risks but can offer opportunities for high returns.

This technique requires staying up to date with the latest trends within the crypto market: only one bad swing trade, and every past profit goes in smoke! - The diversification technique:

Traders would diversify their portfolio across multiple digital assets to reduce risks and also seize opportunities across different market segments.

Simply put, investors put their eggs in different baskets. They open diverse positions on different digital assets to maximize their earnings while reducing the risk of losing a lot with one or two coins only. They could choose according to:

– Various use cases,

– Various blockchains,

– Sectors,

– Market caps,

– Geography…

To give an example here apart from the crypto world, let’s take the oil market: when you buy stocks from different oil companies across the globe, you assume the oil market will go up overall, but you don’t know the particularities of the Venezuelan oil reservoirs. So you invest in several companies to decrease the risk. - The Staking and Yield Farming technique:

Some investors may participate in staking or yield farming activities to earn additional rewards or interest on their crypto holdings.

This requires to lock cryptocurrencies in smart contracts or decentralized finance (DeFi) protocols to support network operations or provide liquidity. In exchange, investors get rewards.

As for Yield Farming, it requires active management: traders provide liquidity to decentralized finance, which comes with significant risks, like impermanent loss, smart contract vulnerability, and market fluctuations…

Whatever the investor type you are and the technique you use, not one of them is more efficient than another. Return on investment is never 100% guaranteed. Let’s keep an eye on the latest trends and prepare efficiently for the next bull run!