Staking Crypto : how to generate long-term passive income ?

Passive income with staking crypto

On this page, you'll learn how to save, for a long-term period and earn passive income with the technique of staking crypto.

The word "staking" describes the action of betting, participating or funding.

The user locks a portion of his or her crypto-currency (digital asset) on a transaction network.

Thus, on the one hand, the funds blocked for a certain period of time, allow the validation of the various transactions that take place on the network.

On the other hand, the user is rewarded proportionally according to the amount blocked and the chosen period. This is called staking rewards.

But then, many questions arise. Here is a non-exhaustive list:

- How does this concept work in practice?

- How do I get started and what are the conditions?

- What are the benefits and risks?

- How much can you expect to earn?

- Which platforms/crypto should you bet on?

Galeon will help you answer all these questions. Ready to save?

PART 1 - THE BASICS OF STAKING crypto

In this first part, we will see the basics of staking and how the proof of validation of exchanges on the blockchain is inspired by mining and proof of work (PoW).

You will discover the proof of stake (PoS) and other concepts.

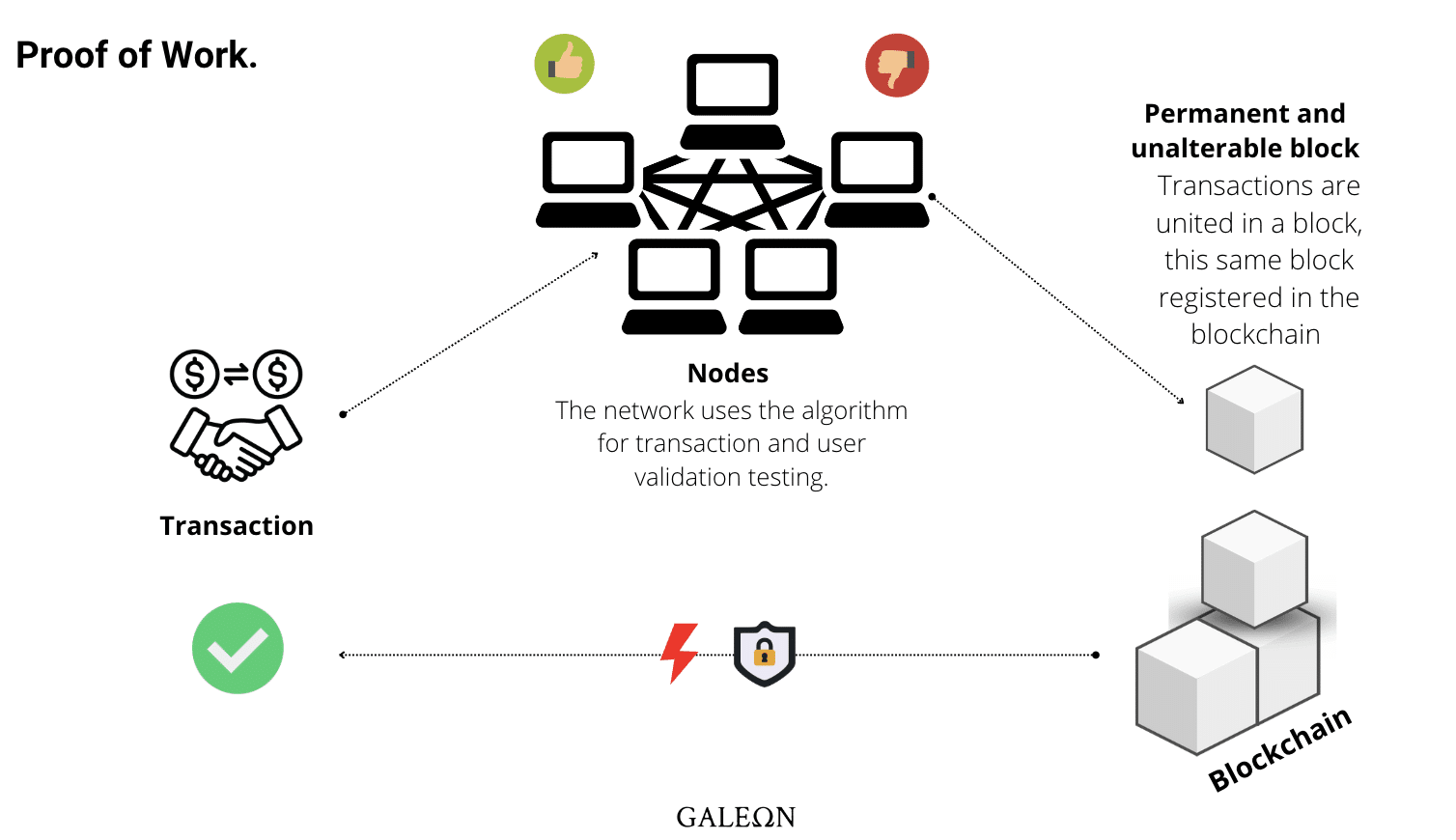

1/ validation WITH THE PROOF OF WORK (POW)

To understand staking, it is necessary to look at the issues and problems of crypto-currency and go back to the basics.

Investor or future investor, you want to ensure the origin of your digital assets (tokens and crypto).

To do so, different validation techniques exist on different blockchains.

Reminder: each blockchain has its own currency (e.g. Ethereum (ETH) or Bitcoin (BTC)) which are called coins. Tokens are a bit different since they are based on an existing currency.

So there are original blockchains and others that became so after an evolution.

Public or private, a blockchain forms a protected network of blocks in which transactions take place. Like a digital register, all the operations that are going to be carried out are registered in order to ensure the solvency of each of the participants.

This is the validation test of the transaction lists.

To be added to the network, each block passes a validation test through network nodes.

These ultra-powerful computers are managed by "miners" and can solve complex algorithmic problems. This is the "mining technology" or the Proof of Work (PoW).

Here are the rules, the first miner who solves the equation has the right to add the block of transactions to the network. In return, he is rewarded with coins and more depending on the network.

This technique has its limits:

- It is the law of the strongest that prevails! The more the miner is equipped with powerful computing tools, the more likely he is to be the first to find the solution (and thus to win the profits);

- These devices are very energy consuming;

- If validators do not associate themselves in mining pools, they have little chance of being selected individually

This is where an alternative to generate passive income comes in: staking with "proof of stake" or "proof of participation" (PoS).

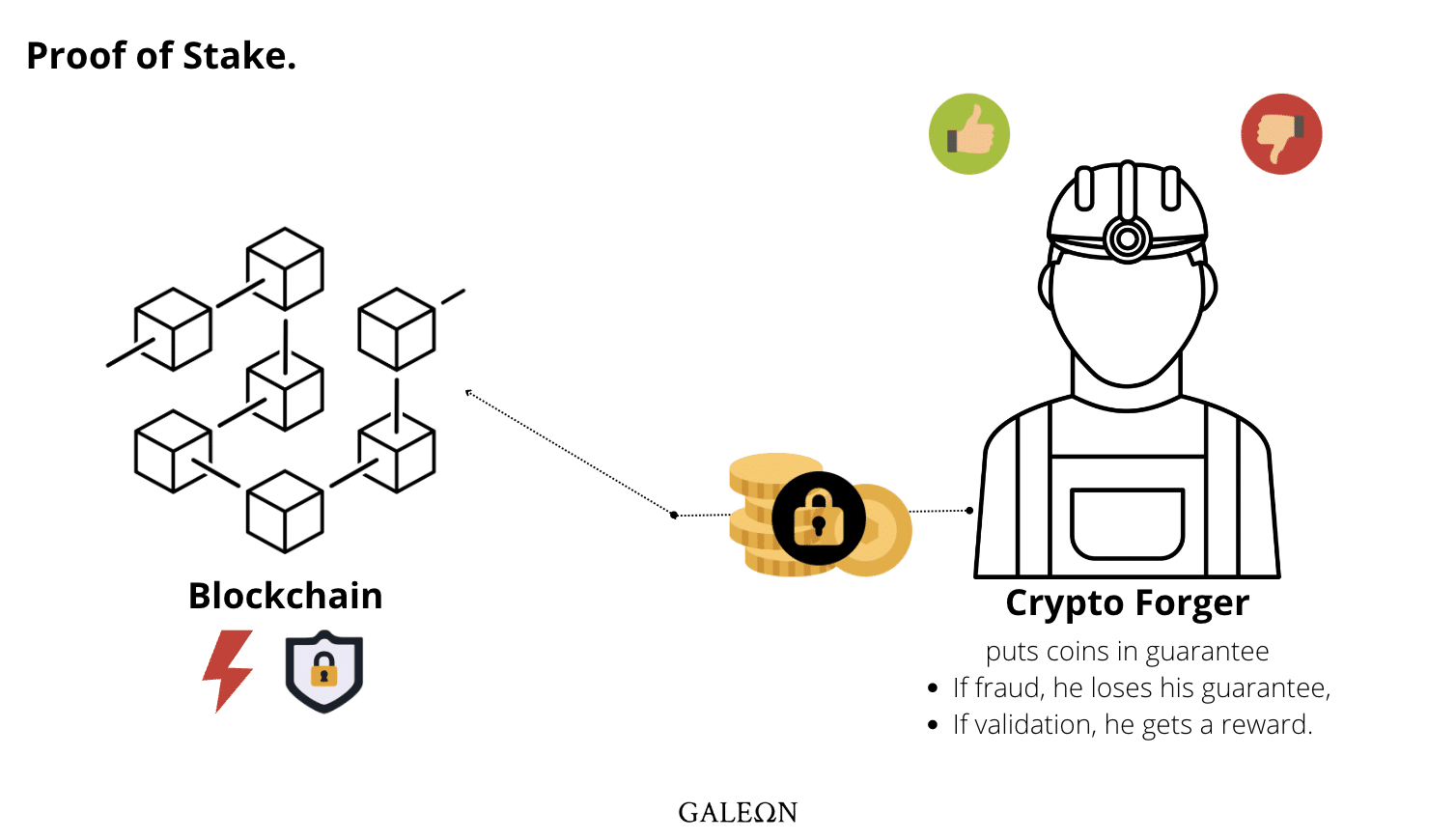

2/ VALIDATION BY THE PROOF OF STAKE (POS)

With staking, you will "save" crypto on a network according to a determined period.

Your digital assets are then blocked and you will receive rewards in proportion (⚠️ until the end of the term, you will not be able to claim your tokens).

To consolidate a network, you need to add new blocks, and to do so, you will have to go through the validation process. Because more blocks means more liquidity, and therefore more risk. This is the Proof of Stake (PoS) stage.

The rules? Bring what is called the proof of stake or the proof of participation, that is to say, that you have indeed put in play a part of your assets.

No more need for high-powered devices to validate a transaction. The simple fact that you have tokens makes you eligible to be a forger. You will simply be counted on to effectively participate in the game through the "security deposit".

⚠️ Notes:

- the more tokens a forger has, the more likely he will be selected.

- At the same time, the more the number of tokens on a network increases, the more the security is weakened. With staking, you will "save" crypto-currency on a network according to a determined period.

3/ other concept of validation (PROOF OF HOLD (POH)...)

Other methods derived from PoF allow to vary the stakes techniques:

- Proof of Hold. Here, the proof is based on the fact of having held your assets for a minimum time (minimum holding time),

- Proof of Use (PoU). Somewhat criticized, it consists in carrying out transactions. However, some people are content to exchange lots of small amounts, thus increasing the validation rate of the following blocks,

- Proof of Importance (PoI), which depends on the number of tokens (it is not the most egalitarian technique, even if levels are created in order to regulate the whole),

- Proof of Stake/Time (PoST). Similar to the PoH concept, however, the proof is based on the total holding time

Delegate Proof of Stake (DPoS), works like staking except that you already know which nodes are designated in advance. You can then choose which node you delegate the validation of the corners to. Note that you still get your rewards. It's a much safer system.

PART 2 - HOW TO START STAKING crypto?

What is the best time to stake ? Which crypto-currency and which tool to choose? Or how much can you earn?

1/ WHICH ASSET/CRYPTO TO CHOOSE FOR STAKING ?

Before we get into the nitty-gritty, a quick aside on the case of NFTs.

NFT staking is still in its infancy, but some projects are planning this possibility in their program.

Thus, it would be a great way for holders to be able to generate passive income. Patience, then... ?

Let's start again. The best thing you can do about this is to educate yourself with all the comparisons that exist online. These are updated regularly.

Regardless, the number one rule is still to take the course. Experts generally recommend to trade on stable coins (ex: USDT or USDC).

This is because they are backed by currencies like the dollar or the euro. There is therefore less risk in relation to price volatility.

2/ THINGS TO CHECK BEFORE GETTING INTO STAKING

Before looking at the return, it is better to know the minimum conditions and other factors.

In our case, it will be the duration of the immobilization of assets and the minimum volume to be staked.

These conditions are of course to be taken into account along with other elements:

- The number of places available and still available,

- The number of participants,

- An interest rate that may decrease with time.

At Galeon, for example, our largest 3-year staking program only requires a minimum of 500 Galeon.

3/ HOW MUCH you can earn?

It all depends on the crypto you are going to trade.

For those that are at the top of the list, like Ethereum, Cardano or Polkadot, your rewards can reach between 5 and 20% on average.

In comparison, smaller crypto can very well reach 100% (beware of wobbly projects though).

In addition to keeping yourself informed about the price of the relevant corner, it may be interesting for you to make a simulation of the interest charged by a particular platform.

While some projects opt for simple interest (APR), others will rely on the technique of compound interest (APY). This way, you can get an idea of how much you will earn in the coming months/years.

For this, no need to get out the calculator or to open an excel table, sites have been created especially for that.

All you have to do is type "simple/composite interest calculator" or "compound interest calculator".

Reminder: APR (annual percentage revenue) and APY (annual percentage yield) are indices that represent the rate of return.

The first one takes into account only the simple interests and applies only to the starting sum; and the second one takes into account the capitalization of the previous interests.

In fact, we can see that platforms such as Binance, Coinbase or Kraken offer the most advantageous rate in terms of staking rewards.

We mentioned it in the previous paragraph, but remember that the profit you will make does not depend only on the interest.

The number of participants matters, the available seats, and the lock-in period. The more stakers there are, the less you are likely to earn in proportion.

4/ WHEN IS THE BEST TIME TO STAKE?

The evolution of prices on the market is something you should absolutely follow if you want to make the most of any staking operation.

There is no single best time to stall, however, some conclusions can be drawn from certain experiences.

If there is an uncontrolled price movement, for example, do not make the mistake of jumping at the first opportunity.

When the market is turned upside down, prices tend to fall as fast as they managed to reach that all-time high!

As another example, during a Bull Run (i.e. strong growth for an extended period of time), smart investors are never far away.

Be careful here, the growth is exponential, but it remains controlled.

5/ WHAT TOOLS SHOULD BE USED TO STAKE? PLATFORM, WALLET, STAKE BOX?

The good news with staking is that stakers don't have to put much effort. You lock in your funds and then harvest the seeds you sow.

To stake, you can simply use: a platform, a wallet or invest in an external hard drive specifically designed for this purpose.

From the Galeon Dashboard, simply connect your Metamask Wallet or Wallet Connect.

- Rely on a staking platform. Nothing could be easier than staking your tokens via a platform, since you go through an intermediary (to choose the best platform see part 6).

- Use a wallet directly. This way, you don't use any intermediary, so there are no management fees. A crypto-currency wallet works like a bank account. Each transaction requires your public address (your login ID) and an access password (the private key).

- Get a staking box. Some companies offer kits like the Raspberry Stake Box that allows you to stake, without even making an effort (other than having to use your wallet). You connect the box to an internet connection and you get continuous passive income.

Buy your first crypto easily by credit card with Galeon

PARTIE 3 - ADVANTAGES AND DISADVANTAGES OF STAKING

For several reasons, staking can be a more advantageous alternative to mining. Especially since the projects are multiplying.

However, some drawbacks and risks are reported by the community.

1/ THE MAIN ADVANTAGES OF STAKING

Staking is an attractive concept for several reasons:

- Less expensive to set up with the PoS technique, you don't need to invest in mining machines.

- Less expensive, too, because you don't need to have a large starting capital.

- Easy to use, you can decide to delegate the block validation process without any additional costs.

- This can increase the price of assets in the long run, because when a number of funds get blocked, they become less accessible. Slowing down their circulation can have this effect of increasing the capital.

- Earn more by using the concept of compound interest*. The principle is to restock some tokens after the lock-in period is over.

? Compound interest principle: when the trend is up, the freshly withdrawn tokens may have increased in value. It can be a good plan to introduce them again in a second round of staking.

This last point can be very interesting, especially during a bear market, which can last a few months or even a few years.

Rather than "waiting" for the general situation to settle down, you can bet on this or that asset according to a period T.

Not only do you get the ball rolling, but you continue to earn your rewards.

Protect the network from bad validators with slashing. If a staker is cheating in any way, he can be reported. From then on, he can lose the invested tokens; the whistleblower can inherit them; and the block added to the network will be deleted.

2/ RISKS AND DISADVANTAGES

Thanks to the experiences of other investors, it is possible to establish a non-exhaustive list of risks and disadvantages related to staking:

- The profits made would be low and/or fixed.

- Comparison with farming (see Part 4): many platforms promise a lot of money with sometimes rates of return far above what staking projects offer (e.g. Siftchain's Rowan with a rate up to 111%!).

On paper, this looks good, however, yield farming requires a real strategy to be put in place, taking more risks.

- Hacking and loss of funds. So be careful to choose your platform carefully and not to take the first project that comes along.

- Disparities between validators, because the amount of earnings is calculated according to the PoS algorithm. Thus, you earn your earnings proportionally to the volume of funds staked and according to the number of participants.

As you can see, it is still the law of the strongest. It is therefore preferable for you to be part of the big fish or, failing that, to be part of a staking pool (in the long term, we can ask ourselves the question of the recentralization of the network).

- Blocking and unstaking* period. Stakers do not have control over their assets since they are blocked for X amount of time, especially during the unstaking period. Sometimes you have to miss out on great opportunities.

The *unstaking period is the period during which you can unstake your tokens. Sometimes you may have to wait a little longer.

So, for the platforms which foresee a minimum delay of 7 days, no worries, for those which foresee delays in weeks, it is another matter!

PART 4 - THE DIFFERENCES WITH FARMING

The concept of Yield Farming or Farming is not so different from staking. Here, it is the farmers who come to deposit a part of their crypto-currency on a network, receiving rewards in return.

So what are the differences? Remember the conditions for staking: blocking crypto for a chosen period of time, with fixed interest.

For farming, you will not be bound by a time limit. On the other hand, you will have to deposit the crypto currencies in pairs. You can withdraw the blocked funds at any time. The profit made can reach higher rates if you adopt a good strategy.

Thus, farming offers you more flexibility in managing your assets. Certainly, nevertheless, the security risks or price volatility have a higher rate.

PARTIE 5 - OPTIMIZE YOUR STAKING REVENUES

?The fiscal rules regarding cryptocurrencies vary from country to country, and are still evolving in many jurisdictions. But let's talk about general principles:

- Capital gains tax: In many countries, cryptocurrencies are treated as property for tax purposes. This means that if you sell or exchange your cryptocurrency for a profit, you may be subject to capital gains tax on the amount of the gain.

- Income tax: If you earn income from your cryptocurrency holdings, such as from staking or yield farming, you may be subject to income tax on that income.

- VAT: In some jurisdictions, buying or selling cryptocurrency may be subject to value-added tax (VAT).

- Reporting requirements: In many countries, you may be required to report your cryptocurrency holdings and transactions to the tax authorities. Failure to report these correctly could result in penalties or fines.

- Anti-money laundering (AML) regulations: In many jurisdictions, cryptocurrency exchanges and other service providers are subject to AML regulations, which require them to verify the identities of their customers and report suspicious transactions to the authorities.

PART 6 - THE DIFFERENT STAKING PLATFORMS

1/ WHAT IS A STAKING PLATFORM?

A staking platform works a bit like a bank. Investors deposit money and earn various rewards with interest rates in exchange.

The platform can then use this money to make loans. The rewards are the acquisition for the investors (creditors) of tokens and other rewards.

2/ HOW TO CHOOSE A PLATFORM FOR STAKING?

First of all, you should know that not all platforms take the same payment methods. This is a small detail that can influence your choice.

Besides, the choice of the platform will depend on several elements: the security and the assistance of the support; the rewards and staking rewards; the commissions taken during all operations.

Security, reputation and support

Collecting passive income is becoming more and more popular and inevitably, it attracts a lot of attention.

In addition to hacks, a number of platforms with more or less "shaky" projects have emerged in recent months. So never forget to take the necessary precautions, whether it is for staking or for any other action.

The reputation of a brand or a service is not everything, but in this case, you will always be advised to bet on structures with a good reputation among the public.

Also ask yourself about the support and its quality. Quick assistance is always a plus.

Rewards

In addition to security, rewards are also an important point.

Ask yourself these questions:

- What profit can you make and what is the interest rate? It can be interesting to make a simulation.

- What are the minimum conditions (minimum amount to be stored and blocking period)?

- What are the payment frequencies?

- Any additional rewards? ...

For more information, see Part 2.

Commissions

Some platforms charge fees directly or indirectly for each operation performed: transaction, deposit, withdrawal. It remains to choose the most reasonable one.

PART 7 - HOW TO STAke WITH GALEON?

Galeon offers several staking programs. If the first 3 programs are already complete, new ones have recently arrived:

- Galeon Karl: 3 year lock-in period, 6% GALEON bonus over 3 years, no Tribe Points requirement, $10,000,000 GALEON available, no minimum stake required.

- Galeon Jarl: 3 year lock-in period, 15% GALEON bonus over 3 years, no Tribe Points requirement, $20,000,000 GALEON available, minimum stake $500 GALEON.

- Galeon King: 3 year lock-in period, 30% GALEON bonus over 3 years, 1 Tribe point equals $25 GALEON, $100,000,000 GALEON available, minimum stake $2,500 GALEON.

How do I proceed?

- Make sure you have Galeon tokens. You can buy them by credit card or directly on our dashboard with your wallet

- Your wallet (Metamask or Connect Wallet) must be connected,

- Go to the Galeon dashboard in the "Staking" section by clicking here

TUTORIAL HOW TO STAKE?

TRIBE POINTS

A new feature that came with the 3 new programs, the Tribe points.

These points reward users for participating and staking $GALEON tokens (reserved for users who invest in the Staking King program).

These points can be used for additional bonuses, such as: the purchase of merchandise, NFTs, access to exclusive events, meeting the Galeon team, donations to associations/NGOs.

Note that other types of actions will allow users to earn tribe points.

The purpose of this article is above all to simplify technical concepts related to crypto-currency, in order to make them accessible to everyone. These words engage only their author. It is not intended to advise the reader on his investments.

WANT TO BUY YOUR 1ST CRYPTOCURRENCY EASILY?

Invest on the Galeon crypto by credit card